“The more work you put in on your outline and getting the skeleton of your story right, the easier the process is later.” – Drew Goddard

A famous but not so famous quote by Andrew Brion Hogan Goddard, better known as Drew Goddard, a famous American film and television screenwriter, director, and producer, explains the utility of skeleton structure of any undertaking that needs to be functional to bear productive output. Likewise, the skeleton structure plays a pivotal role in the human body when it comes to supporting and protecting the body to make it functional. Similarly, the constitution of a company is not possible without a crucial document called the Memorandum of Association (MOA). MOA forms the skeleton structure of a company. The foundation of a company lies in the appropriate drafting of MOA. That is what makes a company operational and provides longevity to the central machinery of a company, in the long run, to function effectively. MOA is a charter of a company which empowers a company to operate for a definite purpose and function within a set of prescribed objectives.

Definition of Memorandum of Association (MOA):

Section 2(56) of the Companies Act, 2013 defines MOA as the Memorandum of Association of a company which could originally be formed and altered from time to time in pursuance of any previous company law or this Act.

In the case of Ashbury Co. v. Riche, Lord Cairns explained in detail the constituents of the MOA of a company. The ruling states that MOA is a mixture of both positive and negative powers that are being attributed to a company. Positive in a sense, it defines the importance and extension of power which the law confers upon a corporation. Negative because it draws a boundary stating that no other operations could be performed beyond the ambit of powers that are being expressed in an MOA.

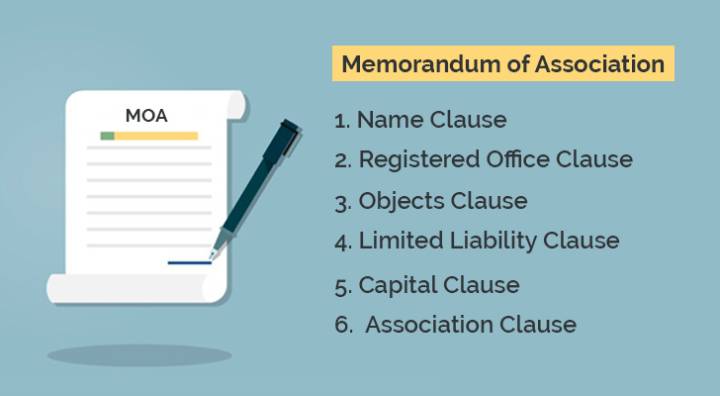

Contents of Memorandum of Association (MOA)

The MOA is crucial in informing the prospective shareholders the objectives and the sector into which they have intended to invest and whether their contractual relationship with the company complies with the objectives prescribed in the MOA.

Following are the contents of the Memorandum of Association (MOA):

1. Name Clause:

A company shall have a name of its own which shall denote its legal existence. However, the name of a company shall not contravene the provisions of the Emblems and Names (Prevention of Improper Use) Act, 1950. A company shall not adopt a name that resembles the name of a company which has already got a legal existence or has been incorporated already. The Central Government could restrain a company from adopting any identical name as that could affect the goodwill of the already existing company and mislead the public in general.

The only way of avoiding the issue of identical name is to make an application to the Registrar of Companies to seek advance approval of the name of a company. The promoters of a company must seek such consent through a proper application procedure made in Form No. 1-A under Rule 4-A of the Companies (Central Government) Rules & Forms, 1956. The Registrar shall provide its approval or rejection within 14 days from the receipt of the application.

The Registrar before granting any approval must conduct a proper investigation relating to the genuineness of the proposed name. However, the Registrar is not expected to perform any detailed investigation except ensuring that the provisions of Section 7 (1) (c) of the Companies Act 2013 have duly complied. The companies shall include the word ‘public limited’, ‘private limited’ and ‘corporation’ as per required. For example, The companies with an authorised capital of 5 crore rupees and above must use the word ‘corporation’ with its name.

2. Registered Office Clause:

A company must always mention in its Memorandum of Association the name of the state in which the registered office of the company is situated. Within 30 days of the incorporation, the company must file the detail of the registered office in Form No. 18 with the Registrar of Companies.

Section 12 (1) of the 2013 Act states that a company within 30 days of its incorporation or before commencing its business must have a registered office. The purpose of having a registered office is many folds which include the feasibility of any person or the Registrar in serving notices, documents and other communications to the public. The public records of a company are generally kept in the registered office of the company, which is another reason why a company must have a registered office, and its location must be known to the public.

3. Objects Clause:

The object clause in a Memorandum of Association (MOA) holds immense importance as it sets out the purpose for which the company has been formed and the nature of the business it intends to conduct. The object clause is divided into three parts, namely:

a) Main Objects: The main objects consist of the objectives and undertakings that are to be pursued by a company right after its incorporation.

b) Other Objects: The objectives of a company that are not included in the main objects are added up in the other objects clause.

c) State-wise objects: The companies whose objects extends to other states are required to mention the name of the states into whose territories, their objects extend.

The object clause holds its importance in determining the purpose and the capacity of a company. It helps the subscribers understand their purpose of investing in the capital of a company. The clause itself sets a limitation stating that the company cannot invest in any other sphere that is beyond the purview of the objects clause. In a way, it creates a shield of protection to the creditors by limiting the activities of a company. Therefore, any incidental or consequential activities upon the powers so conferred by the objects clause shall not be ultra vires if and when exercised. The subscribers to the MOA are very much liberated to choose the objects so far, they are legal and are not in contravention to the Companies Act.

4. Limited Liability Clause:

Every company must state the limited liability clause in its Memorandum of A, mentioning the nature of liability that the members hold. If a company as per Section 8 of the 2013 Act, is exempted from using the word ‘limited’ as a part of its name, they must mention in its MOA that the liability of the members is limited. It is further required to note whether the liabilities are limited by shares or by guarantee.

The reason for such a requirement is that if a company is limited by shares, no member of such a company could be called upon to pay more than the unpaid value of the stake held by him. Similarly, a member of a company limited by guarantee, should not be called upon to contribute an amount that is more than his guarantee in the event of the winding-up of the company.

5. Capital Clause:

The capital clause in a Memorandum of Association states the nominal capital with which the company proposes to be registered and the value of shares into which it is divided. However, there are no limitations as to the amount of nominal capital and the value of each share. The capital of a company consists of two parts, namely the equity share capital; and preference share capital.

6. Association Clause:

The Association clause of the Memorandum of Association is also known as the ‘subscription clause.’ The association clause states that the subscribers are willing to form an association as per the objectives mentioned in the MOA and are eager to take up their shares from the nominal capital. All the subscribers must sign the MOA in the presence of at least one witness who shall then attest his signature. The Memorandum of Association has to be subscribed by at least seven persons when it comes to a public company and two when it is a private company. A subscriber willing to withdraw his name from the MOA could do so only before the MOA is registered by the Registrar of Companies, as after registration he is deemed to be in a contractual relationship with the company and cannot withdraw his name from the MOA or back out from the contract.

Forms of Memorandum of Association:

There are four different forms of Memorandum of Association (MOA) which apply to different classes of companies. The forms available in Schedule I for different kinds of companies are as follows:

- The Form in Table A applies to the companies limited by shares.

- The Form in Table B applies to the companies limited by guarantee and not having a share capital.

- The Form in Table C applies to the companies limited by guarantee and having a share capital.

- The Form in Table D applies to unlimited companies not having a share capital.

- The Form in Table E applies to the unlimited companies having a share capital.

A company to be incorporated must follow any one of the above model forms of a memorandum. However, a company could also make their form of a memorandum, provided that the company should follow the general form of the relevant Table. The contents might differ but should be valid and shall fit with the circumstances so mentioned in a specific model form.

Alteration of Memorandum of Association:

While discussing the alteration of Memorandum of Association (MOA), a crucial point must be stated that the alteration of MOA is possible only to the extent necessary for the efficient working of the company. Such alteration shall not affect the liability of the members or creditors. The following are the procedure of altering the features of MOA.

1. Section 13 (2) of Companies Act, 2013 states that the change in the name of a company could only be initiated by passing a special resolution in a General Meeting of the members of the Company and after obtaining Central Government approval. An application has to be made to the Registrar of companies for the availability of a new name. The reasons for effecting a name change has to be stated in the application and filed with the Registrar of Companies.

2. Section 12 of the Companies Act, 2013 states that in case of a change in the registered office of the company from one place to another, in the same city in a particular state, can be affected by an ordinary board resolution and the same shall be intimated to the Registrar within 30 days of the change. However, change in the registered office address from one city to another in the same state requires a special resolution and approval from the Regional Director as per stated under Section 17A inserted by the Companies (Amendment) Act 2000. Intimation has to be filed within 30 days with the Registrar of Companies (ROC).

If the change is from one state to another state, such change involves the alteration of MOA under Section 17 of the Act. In order to effect such an alteration, a special resolution has to be passed. A petition has to be filed to the Central Government to get the approval for the change. Previously such permission was given by the Company Law Board which was amended by the Companies (Amendment) Act, 2002.

3. Under Section 13 of the Companies Act, 2013, the alteration of objects clause comes into effect only by a special resolution so passed by the shareholders and confirmed by the Central Government. Sufficient notice of the alteration has to be provided to the debenture holders and other interested persons. The Central Government shall intimate the modifications to the ROC so that the ROC could appear before the Board and file necessary objections against confirming the alterations if he thinks fit.

4. A company cannot alter its liability clause as insisting the members to take up a fixed share. Such an alteration will be void by law.

5. A limited company can alter its capital clause by an ordinary resolution to increase or reduce its share capital by issuing new shares or by reducing the liability on share capital not paid up, as has been prescribed under Sections 61, 62 and 66 of the 2013 Act respectively. Such alterations need to be notified to the ROC within 30 days of passing the resolution. However, intimation to the Company Law Board is not necessary.

Conclusion:

The Memorandum of Association mainly serves two purposes. Firstly, it notifies the shareholders about the relevant field into which they are investing so that they could necessarily contemplate the risk that comes with their investment. Secondly, the outsiders who are intending to initiate a contractual relationship with the company could get aware of the objectives of the company with the help of MOA and could determine if their contract lies within the ambit of those objectives. Since a company cannot exercise any activities beyond the purview of the Memorandum of Association to prevent any ultra vires activities, the company must carefully draft the MOA.

It must ensure that its limitation must include all the activities in which the company may engage. However, there is always room for alteration in the Memorandum of Association as has been discussed above, but that again demands much hassle including the passing of a special resolution.

The Memorandum of Association once registered, has its binding effect. Section 10 of the Companies Act, 2013 states that the MOA once registered binds a company and its members in the same way as if the company has signed them. The provisions of Section 10 apply to all the members irrespective of the fact whether they became members through allotment, transfer, or transmission of shares. Therefore, MOA is a very crucial document that takes an active part in the functioning of a company. It is a medium of transparency and accountability since it restricts the powers, rights, and duties of a company and each of its members. Hence, a careful and draft of MOA holds utmost importance for a company to carry on an effective business.

This article has been written by Amrapali Mukherjee, LL.M in Commercial and Corporate Law student at Queen Mary University of London.

Also Read – Articles Of Association – Meaning And Contents Of AOA