ABSTRACT

“To regulate the issue of Bank notes and the keeping of reserves to secure monetary stability in India and to operate the currency and credit system of the country to its advantage”. -Objective of the RBI

The only bank which can accept deposits from both Central and state governments in India without interest is the Reserve Bank of India. The fiscal year for the government starts on April 1 every year and ends on March 31 every succeeding year. However, the financial year for the RBI starts on July 1 in the first year and ends on June 30 in the next year. But, the central board of RBI has decided to change its fiscal year in the coming financial year i.e. for 2020-21. The 2020-21 financial year started from July 1 and it will end on March 31, 2021. Thereafter, all fiscal year will start from April 1.

As indicated by the bank dossiers, the RBI started the procedure on April 01, 1935. In the accompanying segment, the paper will mention how the bank appeared. An observation would be seen on the notable demonstrations and the choices that the bank has been a piece of. At last, a sum up by posting the elements of the Reserve Bank of India.

INTRODUCTION

The Reserve Bank of India was set up in the year 1935 as per the Reserve Bank of India Act, 1934. It is the national bank of India dependent on the multidimensional job. It performs significant money-related capacities from the issue of cash notes to the upkeep of financial stability in the nation. At first, the Reserve Bank of India was a private investor’s organization which was nationalized in 1949. Its issues are administered by the Central Board of Directors designated by the Government of India. Since its beginning, the Reserve Bank of India had assumed a significant job in the financial turn of events and money related solidness in the nation.

HISTORICAL BACKGROUND

It all started in 1926 when the Royal Commission on Indian Currency and Finance suggested the production of a national bank for India. Later in 1927, a bill to offer impact to the above suggestion was presented in the Legislative Assembly. However, it was later removed because of the absence of arrangement among different areas of individuals.

The White Paper on Indian Constitutional Reforms suggested the making of a Reserve Bank and a new bill was presented in the Legislative Assembly in the year 1933. After one year the Bill was passed and gotten the Governor General’s consent. The Reserve Bank started tasks as India’s national bank on April 1, 1935 as a private investors’ manage an account with a settled up capital of rupees five crores (rupees fifty million).

In the year 1942, the Reserve Bank stopped to be the money giving authority of Burma (presently Myanmar). Due to which the Bank quit going about as broker to the Government of Burma. In 1948, the Reserve Bank quit delivering focal financial administrations to Pakistan. [1]

Finally in 1949, the Government of India nationalized the Reserve Bank under the Reserve Bank (Transfer of Public Ownership) Act, 1948, and all shares were transferred to the Central Government. This was the period of post-independence and the RBI was comprised for the administration of cash and for conveying the matter of banking as per arrangements of the Act.

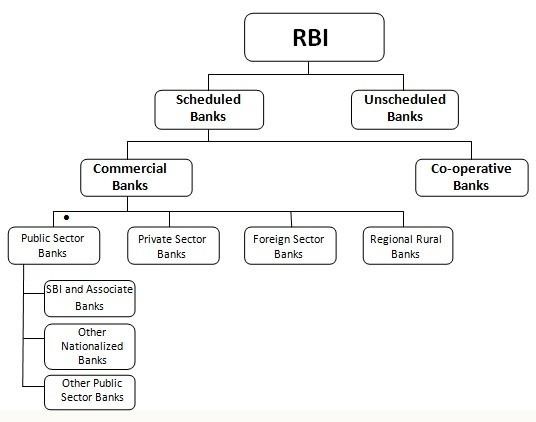

STRUCTURE OF RESERVE BANK OF INDIA

MAJOR PROVISIONS OF THE RESERVE BANK OF INDIA ACT, 1934

SECTION 2(e)- Scheduled Bank means a bank whose name is included in the Schedule II of the RBI Act, 1934.

- Image Source: Sachin Tomar (2013), What is the basic organizational and functional structure of the Indian Banking System?, Quora; https://www.quora.com/What-is-the-basic-organisational-and-functional-structure-of-the-Indian-banking-system

SECTION 3 of the Act demonstrates the foundation of the Reserve Bank of India for taking over the administration of the money from the Central Government and of carrying on the matter of banking as per the provisions of this Act.

SECTION 7 engages the Central Government to issue directions in public interest occasionally to the bank in meeting with the RBI Governor. This part likewise gives intensity of administration and direction of the affairs and business of RBI to Central Board of Directors.

SECTION 17- The section manages the functioning of RBI. The RBI can accept deposits from the Center and the State governments without interest. It can buy and limit bills of the trade from commercial banks. It can buy foreign exchange from banks and offer it to them. It can give credits to banks and state monetary enterprises. It can give advances to the Central government and state governments. It can purchase or sell government securities. It can bargain in subordinate, repo, and invert repo.

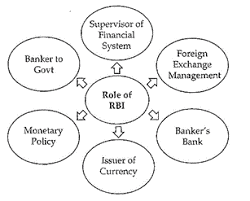

ROLES/ FUNCTIONS OF THE RBI

SECTION 20-21B– The Reserve Bank of India goes about as a banker to the Central government as well as the state governments. All things considered, it transacts all financial business of the government, which includes the receipt and payment of cash for the public authority and doing of its trade, settlement, and other financial tasks. Consequently, the government keeps its money balance on the current account deposits with the RBI. As the banker of the government, the RBI gives short-term credit to the government to meet any setbacks in its receipts over its payment. [1]As the banker of government, the RBI is likewise charged with the responsibility of dealing with the general public (i.e., the government) obligation/ debt. In the release of this duty, the RBI deals with all new issues of government advances, benefits the public debt outstanding, and attendants the market for securities of government.

SECTION 22- 29– RBI in India controls the progression of cash in the market. The primary target is to keep an eye on the credit system and dependent on it keep up the cash in the system. This is done with the goal that the deposits are maintained. Additionally, RBI is the sole position with regards to the printing of cash. This capacity of giving notes by RBI has numerous points of interest. They are:

- It is anything but difficult to administer.

- This aids in the consistency of the notes that are given.

- It turns out to be anything but difficult to control and manage the credit that is within the framework.

SECTION 42– The RBI attempts the duty of controlling credit made by commercial banks. RBI utilizes two techniques to control the additional flow of cash in the economy. These strategies are quantitative and subjective procedures to control and direct the credit stream in the nation. At the point when RBI sees that the economy has adequate cash supply and it might cause an inflationary circumstance in the nation then it crushes the cash supply through its tight money related approach and the other way around.

SECTION 40- To keep the foreign exchange rates stable, the Reserve Bank purchases and sells foreign monetary standards and furthermore secures the nation’s foreign exchange reserves. RBI sells the foreign cash in the foreign exchange market when its stock reductions in the economy and the other way around. Presently, India has a Foreign Exchange Reserve of around US$ 487 bn.

INSTRUMENTS AND MODES OF MONETARY POLICY

It is referred as Federal Reserve. The Central bank maintains it to influence the amount of cash and credit. The monetary policy comprises of the administration of cash supply and interest rates, pointed toward meeting macroeconomic goals, for example, inflation control, utilization, development, and liquidity.

SECTION 49– BANK RATE- It is the standard rate at which RBI is ready to buy or rediscount certain documents including bills of exchange or commercial papers. Bank rates impact the loaning rates of commercial banks. Higher bank rate will mean higher loaning rates by the banks. To control liquidity, the national bank can depend on raising the bank rate and the other way around. The current bank rate is 4.65%.[2]

SECTION 17- OPEN MARKET OPERATIONS– It can accept money on deposit without interest from the Central government or the state government. It can sale, purchase and discount bills of exchange. Under section 17, RBI has much wider authority as compared to section 49. It can buy and sell foreign exchange and can also deal with transactions abroad. Under this provision, RBI acts independently. If the commercial banks reduce rates as compared to RBI then it can go for an open market like other ordinary banks as a participant.

But if the RBI fixes a bank rate and the commercial banks are not ready to sell their promissory notes to the RBI due to the high rate then RBI can participate in the open market and can use the demand and supply rule to fix the price.

SECTION 42- CASH RESERVE RATIO– RBI can tell a bank to keep maximum 20% of all its demand and time liabilities as reserve. CRR is basically the minimum amount of deposit that the commercial banks have to hold as reserves with the RBI. The reason is to ensure that banks do not run out of cash to meet the payment demands of their customers. The present CRR is 3%.[3]

SECTION 24- STATUTORY LIQUIDITY RATIO– Commercial banks have to maintain a stipulated proportion of their demand and time liabilities in the form of cash, gold and unencumbered securities. The proportion is minimum of 40% and the present SLR is 18.50%.[4]

REPO RATE is the rate at which Central bank lends money to the commercial banks when they need it. If there is an increase in repo rate, the liquidity will fall and banks will not take loans in this scenario.

REVERSE REPO RATE is the rate at which RBI borrows money from commercial banks. Both reverse repo rate and liquidity are inversely proportional to each other.

MARGINAL STATUTORY FACILITY- If bank needs an overnight loan, instead of going to another financial institution, it comes to the RBI. Here instead of loans, securities are to be issued.

SELECTIVE CREDIT CONTROL- To select the rate of interest, to whom to give, maximum amount to be given to a single borrower.

ISSUE OF BANK NOTES- As per Section 22 of the Reserve Bank of India Act, RBI has the exclusive right to issue cash notes of different divisions aside from one rupee note. The One Rupee note is given by the Ministry of Finance and it bears the marks of Finance Secretary, while different notes bear the mark of Governor RBI.

Section 24 mentions that the maximum denomination of a note is rupees ten thousand. Whereas section 26 describes the legal tender character of Indian bank notes.

According to section 27 of the Act, the bank doesn’t have the right to re-issue the bank notes that are torn, defaced or excessively spoiled.

RBI & CREDIT INFORMATION

SECTION 45A TO 45G-

It includes any information related to-

- The amount or nature of loan or advances and other credit facilities that are given by the banking companies to their borrowers,

- The nature of security given by the borrowers for such credit facilities,

- The guarantee granted by the banking company to its customers,

- The antecedents, means, credit worthiness and history of financial transaction to the borrowers,

- Any such information that the RBI may consider to be relevant.[5]

Power of RBI to collect credit information-

- It can be collected in such a manner as the RBI thinks fit.

- It may direct any bank to submit to it the statements related to such credit information.

Any banking company is bound to comply with the regulations of the Reserve Bank of India.

Procedure for granting credit information to banking companies-

On request of a banking company, the RBI shall furnish the applicant with that credit information related to the matters stated in the application. But the information so furnished will not disclose the names of banking companies who have submitted such application to the RBI. It is on the discretion of the RBI to put fees for furnishing credit information and that amount would not exceed to rupees twenty-five.

Disclosure of information prohibited-

Any credit information contained in any statement should be kept confidential and should not be published or disclosed except for the purpose of this chapter.

Those exceptions are-

- Disclosure made by any banking company with the prior permission of the RBI.

- If the bank thinks fit, it may publish the credit information in favor of public interest.

- The disclosure or publication can be done as per the practice and usage customary among bankers or permitted by any other law.

- It can be done under the Credit Information Companies (Regulation) Act, 2005.

OBSERVATION

The RBI plays a vital role in the banking industry, the growth and development of the economy. From design policies on issuance of currency to monetary permanence and preservation of that monetary firmness is the responsibility of the RBI. For fulfilling this duty of credit control, the Central bank uses quantitative and qualitative measures such as- bank rate policy, open market operations, SLR, CRR, margin requirements, rationing of credit, etc. It acts as a parent to all the commercial banks and banking institutions within the territory of India.

References

[1] Hemant Singh, What are the main functions of RBI?, Jagran Josh (Mar 31, 2020); https://www.jagranjosh.com/general-knowledge/what-are-the-main-functions-of-reserve-bank-of-india-1488794634-1

[2] https://www.myloancare.in/rbi-monetary-policy/

[3] Supra 4

[4] Supra 4

[5] The Reserve Bank of India, 1934, BareAct

[1] Origin, History and Functions of RBI; https://www.toppr.com/guides/general-awareness/rbi/origin-history-and-functions-of-rbi/

This article has been written by Malini Raj, 3rd Year; BBA LLB student at UPES, Dehradun.

Also Read – A Note on Finance Commission of India