Introduction

The Insolvency and Bankruptcy Code, 2016 (the Code, 2016) consolidates the law of insolvency and bankruptcy in India. Insolvency refers to a situation when an individual or an organisation is unable to pay off its liabilities and the liabilities exceed the value of the assets. Bankruptcy is a legal state when an individual seeks aid from the government to deal with its creditors. Therefore, during the insolvency process, an organisation can rearrange its business operations to avoid bankruptcy[1].

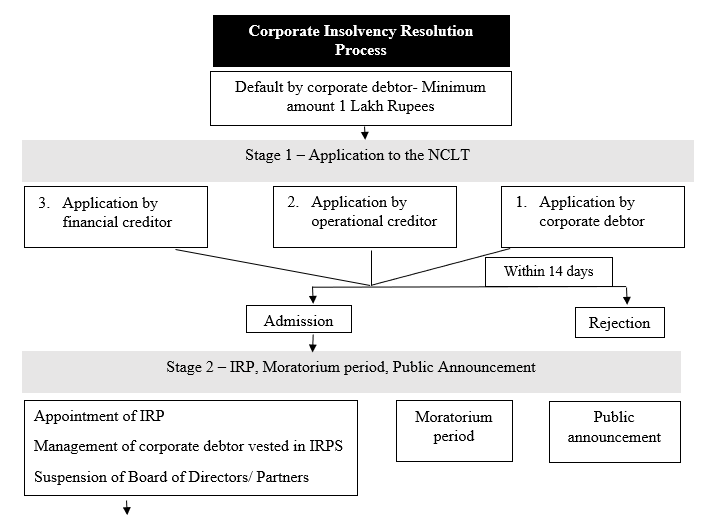

Part II of the Code, 2016 lays down provisions for the corporate insolvency resolution process (CIRP). CIRP is applicable when a default of at least 1 lakh Rupees[2] occurs on part of a corporate debtor i.e. a company or a limited liability partnership[3]. The National Company Law Tribunal (NCLT) is the adjudicating authority for CIRP[4]. The Code, 2016 specifies that the CIRP shall be completed within 180 days from the date of admission of the application. An extension of a maximum of 90 days may be granted by the NCLT upon application by the resolution professional. The application for extension has to be approved by the committee of creditors (COC). Such an extension can be granted only once. The maximum period for completion of CIRP is 330 days which includes the normal CIRP period of 180 days, the extension of 90 days and the time taken to complete legal proceedings related to CIRP of the corporate debtor[5].

The process of corporate insolvency is explained below-

Stage 1- Application to the NCLT (Sections 6 to 11)

An application for initiation of CIRP can be filed by a financial creditor, an operational creditor and the corporate debtor. The CIRP process initiates from the date of admission of the application by the NCLT.

Application by financial creditor- When a default occurs a financial creditor, individually or jointly with other financial creditors, may apply for initiating CIRP before the NCLT. The application has to accompanied by a record of default and proposed interim resolution professional (IRP). Based on records and other evidence provided, the NCLT within 14 days ascertains to either admit or reject the application.

Application by operational creditor- Upon default, an operational creditor may send a demand notice to the corporate debtor demanding the payment in default. Within 10 days of receipt of demand notice, the corporate debtor has to notify the operational creditor about any dispute concerning the payment in default or notify the repayment of the debt. If the corporate debtor fails to respond, the operational creditor may apply for the initiation of CIRP before the NCLT. The application has to be accompanied by a copy of demand notice, affidavit stating that the corporate debtor did not respond and evidence of non-payment of operational debt. The operational may propose an IRP. It is not mandatory for an operational creditor to propose an IRP. The NCLT shall then determine, within 14 days, whether to admit or reject the application.

Application by the corporate debtor- In case of default, the corporate debtor may file an application for initiating CIRP before the NCLT. The application shall be accompanied by information regarding the books of accounts, proposed IRP and the special resolution passed by the shareholders or partners of the corporate debtor, as the case may be, approving the filing of the application. Within 14 days of receipt of the application, the NCLT shall either admit or reject the application.

Stage 2- Interim Resolution Professional (IRP), Moratorium and Public Announcement (Sections 13 to 20)

After the admission of the application, the NCLT appoints an interim resolution professional on the date of commencement of the insolvency process, declares a moratorium period and causes a public announcement. The public announcement contains information about the corporate debtor, the last date of submission of claims, details of IRP, penalties for false and misleading claims and date of closure of CIRP. The IRP is vested with the management of the corporate debtor and the board of directors or the partners, as the case may be, are suspended from the date of appointment of IRP. The IRP takes all actions to keep the corporate debtor as a going concern. He collates all the claims received against the corporate debtor and determines the financial condition of the corporate debtor.

During the moratorium period following activities are prohibited-

1. Institution of new suits and continuation of pending suits or proceedings against the corporate debtor;

2. Transfer, encumbrance, alienation or disposal of assets, legal rights or beneficial interest of corporate debtor;

3. Foreclosure, recovery or enforcement of security interest created by the corporate debtor;

4. Recovery of property that is occupied or in possession of the corporate debtor.

However, the supply of essential services or goods to the corporate debtor is not terminated or interrupted.

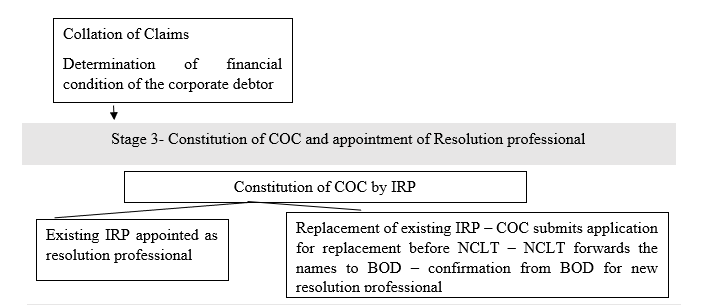

Stage 3- Constitution of Committee of Creditors (COC) and appointment of Resolution Professional (Sections 21 to 28)

In the next stage, the IRP constitutes a committee of creditors comprising of the financial creditors. In the first meeting of COC, either the existing IRP is appointed as the resolution professional or it is replaced by a new resolution professional. The appointment of a new resolution professional requires the permission of the NCLT. The NCLT forwards the names of the resolution professional to the Board for confirmation of the appointment of the resolution professional. If the Board rejects the proposed resolution professional, the existing IRP continues to be resolution professional unless the Board confirms a resolution professional. The resolution professional is conferred with powers and duties that were vested in the IRP.

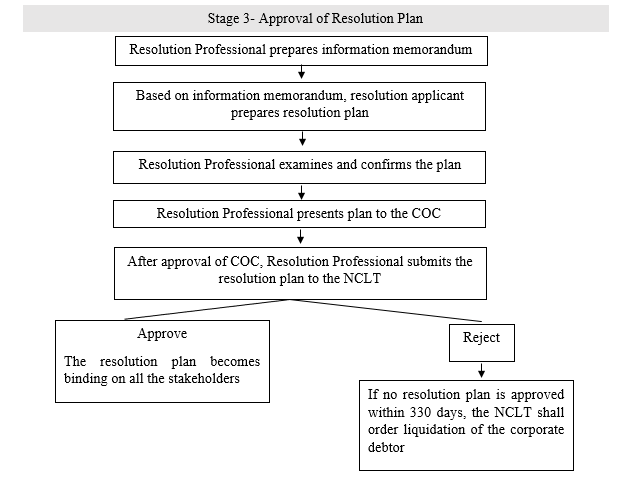

Stage 4- Approval of the resolution plan (Sections 29 to 33)

The Resolution professional prepares an information memorandum that has relevant information required to formulate a resolution plan for the revival of the corporate debtor. The resolution applicant prepares a resolution plan and submits it to the resolution professional for approval. After resolution professional thoroughly examines the resolution plan and is satisfied that the plan provides payments required under the Code, 2016, the resolution professional presents the resolution plan to the COC for its approval. The resolution plan which is approved by COC is then submitted to the NCLT.

Once the NCLT is satisfied that the provisions of the resolution plan confirm with the provision of the Code, 2016 and they can be implemented effectively, the NCLT approves the resolution plan. Such an approved resolution plan is binding on the corporate debtor, its employees, members, creditors, guarantors and other stakeholders. The moratorium period ceases upon approval of the resolution plan by the NCLT. However, the NCLT may reject the resolution plan for non-compliance of requirements under the Code, 2016. If no resolution plan is approved within the maximum time allowed under the Code, 2016, the NCLT shall order the liquidation of the corporate debtor.

Figure 1

Source: Author

1]Taxaman, ‘The Difference between Insolvency and Bankruptcy’ (Taxman, 2018) <https://www.taxmann.com/blogpost/2000000380/the-difference-between-insolvency-and-bankruptcy.aspx> accessed 14 June2020

[2] The Insolvency and Bankruptcy Code, 2016, s.4(1)

[3] Ibid, s. 3(7), 3(8)

[4] Ibid, s. 5(1)

[5] Ibid, s. 12

This Article is Authored by Priyanshee Mathur, LLM Commercial and Corporate Law Student at Queen Mary University of London.

Also Read – How To Incorporate A Public Limited Company?