INTRODUCTION

“A bank may receive interest simply by permitting customers to overdraw their accounts or by purchasing securities and paying for them with its own cheques, thus increasing the total bank deposits.”[1] – Benhams

A central bank is the essential wellspring of cash supply in an economy through the flow of currency. It guarantees the accessibility of cash for meeting the exchange needs of an economy and encouraging different financial exercises, for example, creation, dissemination, and utilization.

Notwithstanding, for this reason, the central bank needs to rely on the reserves of commercial banks. These reserves of commercial banks are the optional wellspring of money supply in an economy. The main function of a commercial bank is the creation of credit.

Credit creation isolates a bank from other monetary establishments. In basic terms, credit creation is the development of reserves. Furthermore, banks can extend their demand deposits as numerous of their money holds since demand deposits fill in as the important medium of trade.

ESSENTIAL CONDITIONS FOR CREDIT CREATION

1. Public depositing cash into commercial banks

2. The eagerness of commercial banks to lend cash to people or organizations as credit.

3. The eagerness of people or organizations in looking for cash from commercial banks as credit.[2]

The two most significant parts of credit creation are:

1. Liquidity – The bank should pay money to its contributors when they practice their entitlement to request money against their deposits.

2. Profitability – Banks are profit-driven undertakings. Hence, a bank should allow credits in a way that acquires higher interest than what it pays on its stores.

Factors affecting the credit creation of a bank-

- The capacity of banks to create credit.

- The accessibility of money deposits with banks.

- The factors which decide their money deposit proportion.

- The willingness of the banks to create credit

- The interest should exist in the market.

- Financially sound borrowers (to avoid bad debts).

- The amount of credit conceded ought not to surpass the paying limit of the borrower.

- Also, the demand for credit in the market.[3]

If the banks are reluctant to use their excess assets for giving advances, at that point the economy is going towards downturn.

In the event that people, in general, withdraws money and holds it with themselves, at that point, it decreases the bank’s influence to make credit.

PROCESS OF CREDIT CREATION

Credit creation is the extension of deposits. The bank’s credit creation measure is based on the suspicions that during any time stretch, just a small proportion of its users truly need money. Likewise, the bank expects that every one of its users would not turn up requesting money against their deposits at one point as expected. There are two different ways of analyzing the credit creation measure:

1. Credit creation by a single bank

In a single bank framework, one bank works all the money deposits and cheques. The process of making credit is clarified in the theoretical model beneath:

If we expect that the bank needs to keep a CRR of 20%.

- In the event that an (individual A) deposits 1,000 rupees with the bank, at that point the bank keeps just 200 rupees in the money hold and loans the excess 800 to someone else (individual B). They open a credit account in the borrower’s name for the equivalent.

- Also, the bank keeps 20% of Rs. 800 (for example Rs. 160) and propels the leftover Rs. 640 to individual C.

- Further, the bank keeps 20% of Rs. 640 (for example Rs. 128) and progresses the leftover Rs. 512 to individual D.

This cycle proceeds until the underlying essential deposit of Rs. 1,000 and the underlying extra holds of Rs. 800 lead to extra or subsidiary deposits of Rs. 4,000 (800+640+512+…).

Adding the initial deposits, we get a complete deposit of Rs. 5,000. For this situation, the credit multiplier is 5 (complementary of the CRR) and the credit creation is multiple times the initial overabundance deposits of Rs. 800.

2. Credit creation by the banking system as a whole

The banking system has numerous banks in it and it can’t give credits in excess of the money it makes. At the point when a bank makes a derivative deposit, it loses money to different banks.

The deficiency of deposits of one bank is the addition of deposits for some other bank. This exchange of money inside the financial framework makes essential deposits and expands the opportunities for additional formation of subsidiary deposits. [4]Here is a representation to clarify this cycle better:

- Bank A makes an initial deposit of 1,000 rupees and keeps 20% CRR and lends the remaining 800 rupees to other bank B.

- Again, it keeps 20% of 800 rupees (i.e. Rs. 160/-) and lends the remaining 640 rupees to Bank C.

- The cycle continues until the initial excess deposit of 1,000 rupees leads to subsidiary deposit of 4,000 rupees. Adding the initial deposits, we get a complete deposit of Rs. 5,000. For this situation, the credit multiplier is 5 (complementary of the CRR) and the credit creation is multiple times the initial overabundance deposits of Rs. 800.

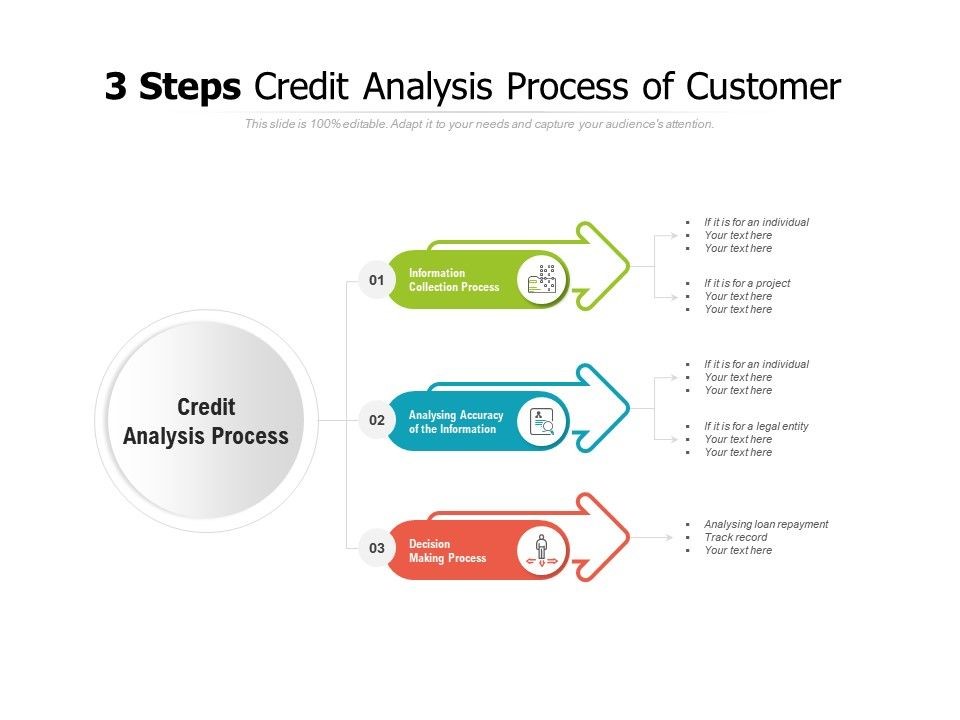

STAGES IN THE CREDIT ANALYSIS PROCESS

The credit examination measure is a long one, enduring from half a month to months. It begins from the data collection stage up to the decision making stage when the bank concludes whether to endorse the advance application and, whenever affirmed, how much credit to extend to the borrower.

Following are the stages-

1. Information collection

The main stage in the credit analyzing measure is to gather information about the candidate’s record. In particular, the lenders are keen on the past reimbursement record of the client, authoritative standing, monetary dissolvability, just as their exchange records with the bank and other monetary organizations. The lenders may likewise survey the capacity of the borrower to produce extra cash flow for the entity by taking a gander at how successfully they used past credit to develop its center business exercises.

The moneylender additionally gathers information about the reason for the advance and its feasibility. The bank is interested on knowing whether the venture to be financed is reasonable and its capability to produce adequate cash flow. The credit analyst allotted to the borrower is needed to decide the adequacy of the loan amount to execute the venture to completion and the presence of a decent arrangement to attempt the task effectively.

The bank additionally collects information about the guarantee of the advance, which goes about as security for the credit if the borrower defaults on its obligation commitments.[6] Generally, banks favor getting the credit reimbursed from the returns of the venture that is being financed, and just utilize the security as a fall back if the borrower defaults.

2. Information analysis

The information gathered in the principal stage is analyzed to decide whether the information is precise and honest. Individual and corporate records, for example, the visa, corporate contract, exchange licenses, corporate goals, concurrences with clients and providers, and other authoritative archives are examined to decide whether they are precise and real.

The credit analyst likewise assesses the fiscal reports, for example, the balance sheet, income statement, cash flow statement, and other related archives to evaluate the monetary capacity of the borrower.[7] The bank likewise considers the experience and capabilities of the borrower in the task to decide their competence in executing the undertaking effectively.

Another perspective that the lender considers is the adequacy of the task. The bank breaks down the reason and future possibilities of the task being financed. The moneylender is keen on knowing whether the project is sufficiently reasonable to create satisfactory cash flows to support the obligation and pay working costs of the business. A productive undertaking will effortlessly make sure about credit offices from the bank.

3. Approval or rejection of the loan application

The last stage in the credit analysis process is the dynamic stage. Subsequent to acquiring and analyzing the proper monetary information from the borrower, the bank settles on a choice on if the evaluated level of danger is adequate.

On the off chance that the credit analyst appointed to the particular borrower is persuaded that the evaluated level of danger is worthy and that the loan specialist won’t confront any test adjusting the credit, they will present a suggestion report to the credit board of trustees on the discoveries of the survey and an official choice.

Notwithstanding, if the credit examiner finds that the borrower’s degree of danger is excessively high for the bank to oblige, they are needed to compose a report to the credit panel enumerating the findings on the borrower’s reliability. The advisory group or other proper endorsement body saves a final decision on whether to affirm or dismiss the credit. [8]

LIMITATIONS

There are limitations on the measure of cash that can be given as credit from the total deposits that a bank gets from the general public. According to the principle, commercial banks need to keep a specific segment of the public deposits as reserves with the central bank which will be utilized for meeting the quick money necessities of the contributors.

Simply in the wake of keeping aside the necessary measure of those reserves, the commercial banks are allowed to loan to people or organizations.

Following are a portion of the restrictions that are capable by the commercial banks during the credit creation measure

1. Money sum present in the bank

The higher the measure of reserves made by people in general, the higher credit creation from commercial banks can be seen, yet there is a sure cutoff on the measure of money that can be held by the banks all at once.

This cutoff is controlled by the national bank, as the national bank may contract or extend this breaking point by selling or buying the protections.

2. Cash Reserve Ratio or CRR

It alludes to the measure of cash in type of a hold that should be kept with the central banks by the commercial banks. This sum is utilized for meeting the money necessities of the customers. Any fall in the CRR will prompt more credit creation.

3. Excess Reserve

This happens when a nation faces downturn, around then banks think that it’s favorable in keeping up reserves instead of lending which prompts less credit creation. In such a case, banks may choose to keep up reserves as opposed to using assets for lending. Along these lines, in such circumstances, credit made by the commercial banks would be little as a lot of money is resented.

4. Cash Drainage

It alludes to the circumstance when the general population isn’t keeping cash in the banks, which brings about diminished credit creation in the economy. Infer that people, in general, don’t deposit all the money with it. Users may hold the money with them which influences the credit creation by banks. Consequently, the limit of banks to make credit lessens.[9]

5. Borrower Availability

Credit creation will thrive if there are borrowers, credit creation won’t be done if there are no borrowers of the cash in an economy.

6. Predominant business conditions

In the event that an economy is seeing a downturn, at that point, the organizations won’t look for credit which prompts withdrawal of credit creation. While, in the event that a country is thriving, at that point organizations will look for new assets as credit from the banks which lead to credit creation.

BRIEFLY EXPLAINED THE THEORY OF CREDIT CREATION

There have been two perspectives on credit creation: one held by specific financial analysts like Hartley Withers, and the other held by down to earth investors like Walter Leaf.

As per Withers, banks can make credit by opening a reserve, each time they advance an advance. This is on the grounds that each time a credit is authorized, the installment is made through cheques by the clients[10]. All such installments are changed through the clearinghouse. Inasmuch as credit is expected, a reserve of that sum stays extraordinary in the books of the bank. Accordingly, every credit makes a reserve. In any case, this is an overstated and outrageous view.

Dr. Leaf and other practical bankers disagree with this view. They go to the contrary extraordinary. They hold that banks can’t make cash out of anywhere. They can loan just what they have in real money. Consequently, they can’t and don’t make cash.

A bank isn’t where one can keep currency notes and guarantee those very notes when one longing. Banks know by experience that everything investors don’t pull out their cash at the same time. Some pull out while others store around the same time.

The bank knows by experience that the client will pull out cash by checks which will be stored by his lenders in this bank or some other bank, where they have their records. Settlements of all such checks are made in the clearing house. A similar strategy is continued in different banks. The banks can make credit or stores by keeping little money available for later and loaning the leftover sum.

At the point when a bank limits a bill of trade, it truth be told, purchases the bill from the client for a brief time of 90 days or less. The amount of the bill is credited in the record of the client who pulls out it through a cheque. [11]Or then again, it pays the entirety through a cheque of itself. In the two cases, the bank makes a deposit equivalent to the amount of the bill of trade less the rebate charges.

A commercial bank likewise makes a deposit by making projects by purchasing government bonds and protections. The bank pays for the bond through a mind itself to the central bank. On the off chance that it purchases a bond from the stock trade, it credits the sum in the record of the customer, in the event that he turns out to be its client. Else, it pays a cheque of itself which is saved in some other bank.

OBSERVATION

In this way, it tends to be surmised that the lower the CRR, the higher will be the credit creation, though the higher the CRR, the lesser will be the credit creation. With the assistance of credit creation measure, cash increases in an economy. Nonetheless, the credit creation cycle of commercial banks isn’t liberated from restrictions. A credit analyst uses various methods like trend analysis, ratio analysis, cash flow analysis and projections to determine the creditworthiness of the borrower. For the homogeneous banking framework with indistinguishable balance sheets, they share a similar restricting guideline. Interestingly, for the heterogeneous banking framework with assorted balance sheets, the coupling guideline for each bank might be not quite the same as others.

[1] Nitisha, Credit Creation by commercial banks and its limitations; https://www.economicsdiscussion.net/banks/credit-creation-by-commercial-banks-and-its-limitations/4155

[2] Credit Creation by commercial banks, BYJU’s; https://byjus.com/commerce/credit-creation-by-commercial-bank/

[3] Credit Creation, toppr; https://www.toppr.com/guides/business-economics-cs/money-and-banking/credit-creation/

[4] Supra 3

[5] 3 Steps credit analysis process of customer, Slide Team

[6] Credit Analysis Process, CFI; https://corporatefinanceinstitute.com/resources/knowledge/credit/credit-analysis-process/

[7] Supra 6

[8] Supra 6

[9] Supra 1

[10] Smriti Chand, Credit creation: The most important function of commercial banks; https://www.yourarticlelibrary.com/banking/credit-creation-the-most-important-functions-of-a-commercial-banks/11011

[11] Supra 10

This article has been written by Malini Raj, 3rd year BBA LLB student at University of Petroleum and Energy Studies, Dehradun.

Also Read – Discuss the Liability of Bank Under Consumer Protection Act, 1986